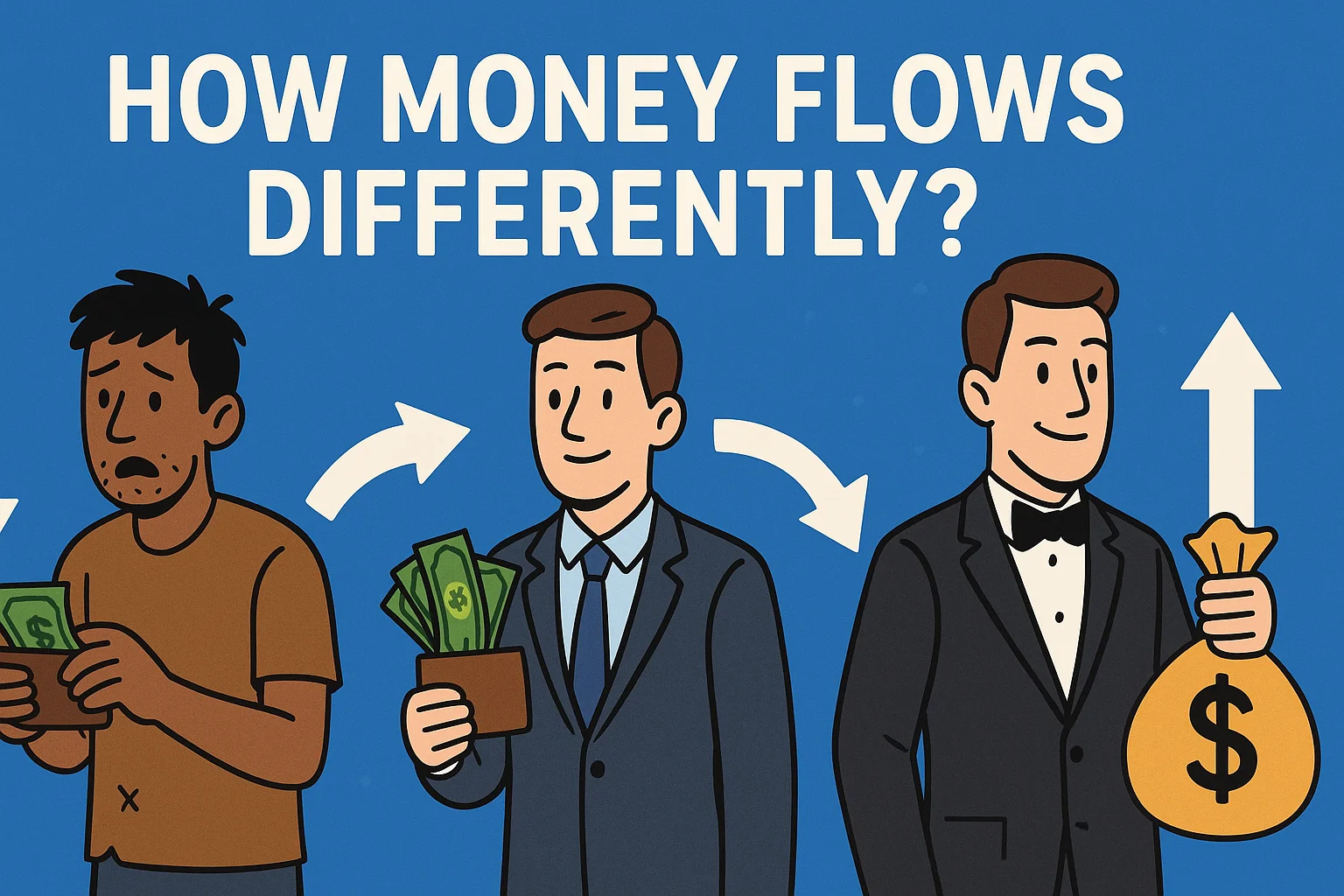

How Money Flows Differently?

Money isn’t about how much you earn. It’s about what you do with it. Some people live paycheck to paycheck. Some struggle despite earning well. And some make money work for them. Let’s see the difference.

Money isn’t about how much you earn. It’s about what you do with it. Some people live paycheck to paycheck. Some struggle despite earning well. And some make money work for them. Let’s see the difference.

Let’s talk about something that actually matters, how money works in real life, and why some people seem to have it all while others just struggle to make ends meet. Money isn’t just numbers on a screen, it’s a reflection of your mindset. How you earn, spend, and invest shapes whether your life grows richer or stays stuck the same. Most people never stop to see where their money actually goes, and that’s why the same patterns repeat across generations. Understanding this is the first step to breaking free.

Understanding the Basics

Before we see how money flows differently, let’s get a few terms straight:

Salary: The money you earn. Simple.

Expenditure: Stuff you have to spend on, needs like food, clothes, and shelter.

Liabilities: Debts or EMIs you owe.

Investments: Money you put somewhere to make more money, passive income.

Now that we’re clear, let’s see how people from different classes actually handle their money, and why it makes all the difference.

Behavior:

All their salary goes straight into covering basic needs: food, shelter, clothes. Nothing is saved, nothing is invested. If they earn 500 rupees, all 500 disappear just to survive. (salary to expenses)

Simple visual:

Imagine filling a bucket with water, but it leaks out immediately. That’s their money.

Takeaway:

They’re stuck in the cycle. No growth. No financial freedom.

Behavior:

They split their money between necessities and liabilities like EMIs or loans. They try to appear rich, buying status symbols, but most of their money is already spoken for. (salary to expenses & liabilities)

Example:

Fancy phones, new clothes, maybe a car. But behind the scenes, the bills are piling up.

Takeaway:

Money works for wants, not for them. They’re trapped in debt, even if the salary looks decent.

Describe behavior:

They cover necessities, pay off any liabilities smartly, and invest a big portion of their income to make passive money. Their money grows while they sleep. (salary to expenses, liabilities if any & invested)

Example:

Spend what you need, invest the rest, and watch it multiply over time. That’s how wealth builds.

Takeaway:

True wealth is about habits, not just earning more. Your money should work for you, not the other way around.

Here’s the real talk: the difference between poor, middle-class, and wealthy isn’t just how much you earn, it’s how you see and manage money. Understanding these patterns gives you power. Even if you’re not wealthy yet, knowing how money flows can help you make smarter decisions, avoid traps, and think like someone in control of their finances.

You don’t need to memorize terms or formulas. You just need to see the patterns, understand the rules, and then the rest becomes obvious.

And that’s what I want for you, you don’t need to become an expert overnight. Start noticing where your money goes, make small changes, and watch how your financial mindset shifts. The more you understand, the more control you gain, and that’s the first step to real freedom.

No matter your salary, your life changes when your money starts working for you. Track it. Spend wisely. Invest smartly. Break the patterns, and let your wealth grow.

Comments

1A good lesson